In today’s fast-paced business environment, transactions such as mergers, acquisitions, and investments require careful examination before any final decision is taken. One of the most important tools used to assess a company’s financial health before entering into such agreements is Financial Due Diligence (FDD). This process is crucial for investors, financial professionals, and entrepreneurs alike to avoid costly surprises and make informed decisions.

This article aims to explain what Financial Due Diligence is, why it matters, who should consider it, how it is conducted, and its legal significance—particularly in the Indian business context. We will also differentiate FDD from audits and discuss client expectations from the process.

Understanding Financial Due Diligence (FDD)

Financial Due Diligence is best understood as a comprehensive financial health check of a company before a transaction such as investment, merger, or acquisition takes place. Much like a medical check-up for a patient, FDD helps verify the company’s financial condition and reveal any hidden risks or liabilities.

The process involves a detailed review of the company’s financial statements, accounting methods, cash flows, liabilities, assets, and future financial prospects. It is performed by a team of experts, including financial analysts, accountants, and sometimes industry specialists, who work together to paint a complete picture of the company’s financial standing.

The primary objective of FDD is to help investors or acquirers make informed decisions based on factual financial analysis rather than relying solely on intuition or incomplete information. It helps identify risks early, verify compliance with accounting standards, and validate the accuracy of the financial information presented by the company.

Why is Financial Due Diligence Important?

Financial Due Diligence plays a pivotal role in business transactions because it:

- Mitigates Risk: By uncovering financial risks such as undisclosed debts, contingent liabilities, or irregular accounting practices, FDD prevents unpleasant surprises after the deal.

- Assesses True Financial Health: It goes beyond surface-level financial statements to assess the sustainability and quality of earnings.

- Helps Accurate Valuation: FDD enables a fair valuation of the company’s assets and liabilities, which is critical for negotiating the right price.

- Verifies Compliance: It checks whether the company follows the relevant accounting standards and regulations, which is especially important in India’s complex regulatory environment.

- Supports Strategic Planning: The insights from FDD assist in forecasting future performance and strategic decision-making.

In the Indian business context, where regulatory changes and market volatility are frequent, conducting thorough FDD is not just prudent but often essential for successful transactions.

Who Should Consider Financial Due Diligence?

Financial Due Diligence is not a one-size-fits-all process. It is particularly relevant to the following:

1. Investors and Venture Capitalists

If you are investing capital in a company, especially startups or private enterprises, FDD helps assess the financial viability and potential risks involved.

2. Entrepreneurs and Business Owners

Before selling your business or merging with another, FDD prepares you for the scrutiny your company will face and highlights areas needing improvement.

3. Financial Professionals

Chartered Accountants, financial analysts, and auditors involved in mergers and acquisitions often specialise in FDD to assist clients with accurate financial insights.

4. Legal Professionals

Lawyers advising on mergers, acquisitions, or investments need a basic understanding of FDD to evaluate risks and draft appropriate contractual safeguards.

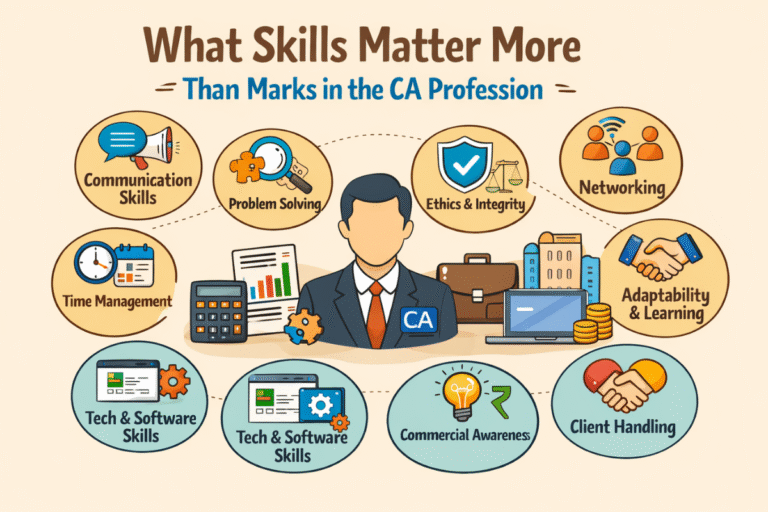

Skills Required for Financial Due Diligence

The field of FDD requires a unique blend of skills and qualities:

- Analytical Ability: To break down complex financial data and identify risks or opportunities.

- Numeracy Skills: Comfort with numbers and financial calculations is essential.

- Attention to Detail: Small errors or omissions can lead to major financial risks.

- Communication: Ability to present findings clearly and concisely to non-financial stakeholders.

- Project Management: Coordinating data collection, analysis, and reporting in a timely manner.

- Commercial Awareness: Understanding market dynamics and business strategies.

- Technical Proficiency: Mastery over tools such as Excel and PowerPoint for data analysis and presentation.

For freshers, having a solid foundation in financial principles, audit cycles, and case-study experience can provide a strong start in this field.

Differentiating Financial Due Diligence from Audit

Although both FDD and audits involve examination of financial information, they differ significantly in scope, purpose, and approach:

| Aspect | Audit | Financial Due Diligence (FDD) |

|---|---|---|

| Definition | Independent examination of financial statements | In-depth investigation of a potential investment or transaction |

| Purpose | To express an opinion on the truthfulness of financial statements | To confirm all material facts before a transaction or investment |

| Scope | Limited to historical financial data and statements | Covers historical data and future financial prospects, including non-financial information |

| Nature | Mandatory for certain companies as per law | Voluntary and transaction-specific |

| Approach | Standardised procedures as per auditing standards | Tailored and focused on transaction risks and opportunities |

The Financial Due Diligence Process: Step by Step

Conducting FDD is a detailed and methodical exercise. Here is a typical stepwise approach:

1. Define Objectives and Gather Information

Clear understanding of the transaction purpose and scope is the starting point. Collect all relevant financial documents, including audited and unaudited statements, tax returns, management reports, contracts, and more.

2. Analyse Financial Statements

Review balance sheets, profit and loss accounts, and cash flow statements thoroughly. Look for trends, unusual transactions, revenue recognition policies, and consistency.

3. Assess Accounting Practices

Ensure that the target company follows acceptable accounting standards such as Indian Accounting Standards (Ind AS). Check for any aggressive accounting or policy changes.

4. Examine Debt and Liabilities

Analyse the structure, terms, and repayment schedules of debts. Identify contingent liabilities such as pending litigation or guarantees that may impact financial health.

5. Review Asset Quality

Inspect both tangible assets (like machinery, land) and intangible assets (like intellectual property) to verify their value and ownership.

6. Evaluate Cash Flow and Liquidity

Understand the cash conversion cycle, working capital requirements, and liquidity position to assess operational efficiency.

7. Conduct Management Interviews

Engage with key management personnel to understand business risks, future plans, and any undisclosed issues.

8. Assess Financial Controls

Evaluate the internal controls and risk management systems in place to identify potential weaknesses.

9. Prepare Due Diligence Report

Compile findings into a structured report highlighting risks, valuation adjustments, and recommendations.

10. Feedback and Negotiation

Use the report findings to negotiate deal terms, price adjustments, or protective clauses.

Legal Significance of Financial Due Diligence in India

From a legal standpoint, FDD acts as a safeguard against future disputes by providing:

- Evidence of Good Faith: Conducting thorough due diligence demonstrates that the parties acted responsibly and prudently before entering into agreements.

- Basis for Representations and Warranties: Findings from FDD often shape the representations and warranties clauses in purchase agreements, protecting buyers from undisclosed risks.

- Risk Allocation: Identified risks can be allocated contractually, with provisions for indemnity, escrow, or price adjustment.

- Compliance Verification: Ensures adherence to Indian financial reporting standards and regulatory requirements, reducing exposure to penalties.

Thus, legal advisors often coordinate closely with financial experts to ensure that the due diligence findings are correctly reflected in transaction documents.

What Do Clients Expect from Financial Due Diligence?

Clients engaging in FDD typically expect:

- Comprehensive and Accurate Analysis: A deep dive into all relevant financial and business data.

- Clear Identification of Risks: Highlighting areas that could materially affect the deal.

- Valuation Adjustments: Suggestions on how risks impact the company’s valuation.

- Practical Solutions: Recommendations to mitigate risks, such as contractual safeguards.

- Timely Delivery: Efficient completion within deal timelines.

Conclusion

Financial Due Diligence is an indispensable step in the lifecycle of any significant business transaction in India. It equips investors, acquirers, and professionals with the critical financial insights needed to make informed decisions, negotiate better terms, and safeguard their interests.

In an environment of increasing regulatory complexity and economic uncertainty, understanding and conducting robust FDD is not merely a best practice but a necessity. Whether you are a financial professional seeking to specialise in this domain, an investor looking to protect your capital, or a business owner planning a transaction, Financial Due Diligence should be a priority in your strategic toolkit.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.