Investing in a company requires careful analysis of its financial health, management, and future prospects. One of the most important documents for this purpose is the Annual Report (AR). However, many investors find Annual Reports lengthy, technical, and overwhelming. This article will guide you on how to read an Annual Report efficiently and understand its crucial components, helping you make informed investment decisions with ease.

What Is an Annual Report?

An Annual Report is a yearly publication by a company detailing its financial performance, management insights, and future plans. It is usually prepared for the financial year ending 31st March and made available on the company’s official website, often as a downloadable PDF. Shareholders typically receive a hard copy as well.

The Annual Report is a public document and includes an auditor’s certification, which ensures the authenticity and accuracy of the information. It serves as the most reliable and official source of data about the company, unlike third-party websites that may sometimes provide inaccurate or misleading information.

Why Is Reading the Annual Report Important?

The Annual Report is crucial because it offers:

- Official and Verified Data: It contains audited financial statements and official disclosures.

- Insight into Management: It reveals the company’s leadership approach and management philosophy.

- Complete Information in One Place: The report covers various important aspects — from financials to corporate governance — in a single document.

For any investor, the Annual Report is the starting point to understand a company’s overall health and decide whether it is worth investing in.

Challenges in Reading the Annual Report

Despite its importance, many find the Annual Report difficult to read because:

- It is very lengthy, sometimes running into hundreds of pages.

- It contains complex jargon and technical terms.

- It includes many advertisements and promotional content, which may distract from important information.

- Useful data often gets lost in the clutter.

Due to these reasons, many investors skim through or ignore the report altogether, which can lead to uninformed decisions.

Common Mistakes Investors Make While Reading Annual Reports

- Ignoring Details: Skipping important sections or assuming some parts are not useful.

- Focusing Only on Numbers: Considering only the financial statements without understanding management insights or risks.

- Missing Managerial and Governance Aspects: Overlooking who runs the company and how it is governed.

- Not Evaluating Risks: Ignoring business risks and future plans detailed in the report.

The 80/20 Rule: Focus on What Matters Most

Given the size and complexity of Annual Reports, it is practical to focus on the most important 20% of content that affects 80% of your decision-making. Here are the key sections you should prioritise:

- Initial Page

- Chairman’s Letter

- Board’s Report

- Shareholding Information

- Report on Corporate Governance

- Management Discussion & Analysis (MD&A)

- Consolidated Financial Statements

Let’s break down each of these parts for better understanding.

1. Initial Page: Know Who Runs the Company

The initial pages of the Annual Report provide details about the company’s management and key personnel.

- Management Names: Familiarise yourself with the people running the company. The reputation and experience of the management team can strongly influence the company’s performance.

- Family Control: Some companies have significant family involvement. This can be positive if the family has a good track record (like the Tata Group), but excessive family control might restrict corporate democracy.

- Chief Financial Officer (CFO): The CFO plays a vital role in financial planning and risk-taking decisions. Understanding who this person is can give insights into the company’s financial discipline.

- Auditors: Auditors act as watchdogs to verify the accuracy of financials. Reliable and reputed auditors add confidence.

- Bankers: Knowing the company’s bankers is important, especially post major financial scams in India. Good banking relationships indicate financial stability and credibility.

2. Chairman’s Letter: The Big Picture

The Chairman’s Letter offers a high-level overview and is often a good indicator of the company’s culture and transparency.

- Tone and Honesty: Check how openly the chairman discusses the company’s successes and challenges. Honest communication reflects well on corporate governance.

- Industry Overview: This section might mention the industry environment, seasonal impacts, or government policies affecting the company.

- Business Segments: If the company operates in multiple sectors, the letter often highlights which areas are doing well and which face difficulties.

3. Board’s Report: Governance and Management Details

The Board’s Report contains vital information related to company governance and management practices.

- Subsidiaries: Companies often hold stakes in other firms. Evaluate the nature and risk profile of these subsidiaries because they affect the parent company’s financials.

- Management Salary: Scrutinise how much the directors and management are paid. Excessive salaries at the cost of shareholders’ returns can be a red flag.

- Related Party Transactions (RPT): These are transactions between the company and parties related to management. Frequent or large RPTs may indicate potential conflicts of interest.

4. Shareholding Information: Understanding Ownership

This section tells you about the company’s ownership pattern, which is important for assessing control and investment interest.

- Promoter Holdings: High promoter shareholding often indicates commitment but may also mean concentrated control.

- NRIs and Foreign Investment: Shares held by Non-Resident Indians and foreign investors are subject to government regulations and may affect profit repatriation.

- Mutual Funds and Institutional Investors: The presence or absence of institutional investors can indicate the company’s market reputation and risk level.

5. Report on Corporate Governance: Board and Compliance

Corporate governance reports provide insights into how well the company follows ethical and legal norms.

- Board Composition: Check whether the board is diverse and independent. A board dominated by a few insiders might compromise objectivity.

- Director Remuneration: Evaluate if director payments are justified by company performance.

- Disclosures: This section details important matters such as corporate social responsibility (CSR), IPO expenses, and related party dealings. Transparency here is critical.

6. Management Discussion & Analysis (MD&A): Deep Dive into Business

This is one of the most important sections, providing management’s perspective on the company’s operations and outlook.

- Industry Position: Understand where the company stands within its industry and its market share.

- Capacity Utilisation: Full use of production capacity usually means better efficiency and profitability.

- Capital Expenditure (Capex) Plans: Check the company’s investment plans for growth and expansion — where, how much, and why.

- Sector-wise Performance: If the company operates in multiple sectors, this part highlights the profitability and risks of each.

- Business Risks: Assess economic, political, financial, and operational risks and how the company manages them.

7. Consolidated Financial Statements: The Numbers That Matter

Financial statements are the backbone of the Annual Report and provide objective data on the company’s performance.

- Balance Sheet: Shows assets, liabilities, and shareholders’ equity. Look for liquidity, debt levels, and working capital.

- Profit & Loss Account: Displays revenue, expenses, and net profit. Compare year-on-year figures to identify trends.

- Cash Flow Statement: Tracks cash inflows and outflows from operating, investing, and financing activities. Healthy cash flow indicates good financial management.

Consolidated statements include the parent company and its subsidiaries, providing a complete picture of financial health.

How Much Time Should You Spend Reading the Annual Report?

A thorough reading of the Annual Report does not require days. You can allocate your time as follows:

- Initial Page, Chairman’s Letter, and Corporate Governance: Spend 5-10 minutes on each.

- Management Discussion & Analysis and Financial Statements: Spend about 30 minutes each, as these contain the most critical data.

In total, around 1.5 hours of focused reading will help you understand the company comprehensively and make better investment decisions.

Final Tips for Reading Annual Reports

- Read with a Purpose: Know what you want to find out — financial health, management quality, risks, or future growth.

- Avoid Getting Distracted: Skip ads and unrelated sections.

- Make Notes: Jot down key points or questions for further research.

- Compare Across Years: Look at reports from previous years to identify trends and changes.

- Use Supplementary Tools: Websites like the Ministry of Corporate Affairs (MCA) portal can help verify company filings.

Conclusion

Reading an Annual Report may seem daunting initially, but by focusing on the key sections and understanding what to look for, you can extract meaningful insights without getting overwhelmed. This helps you make well-informed decisions about investing in a company, ensuring your money is placed wisely.

Remember, the Annual Report is the company’s official story to its investors — reading it carefully equips you with knowledge to separate good investment opportunities from risky ventures.

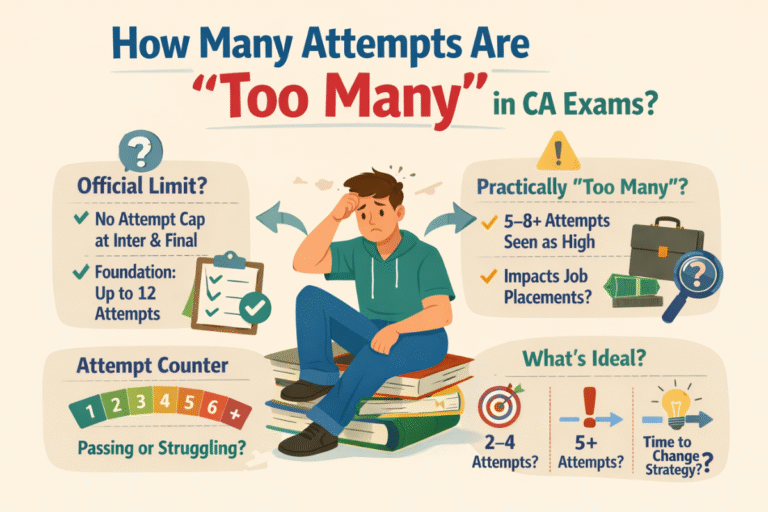

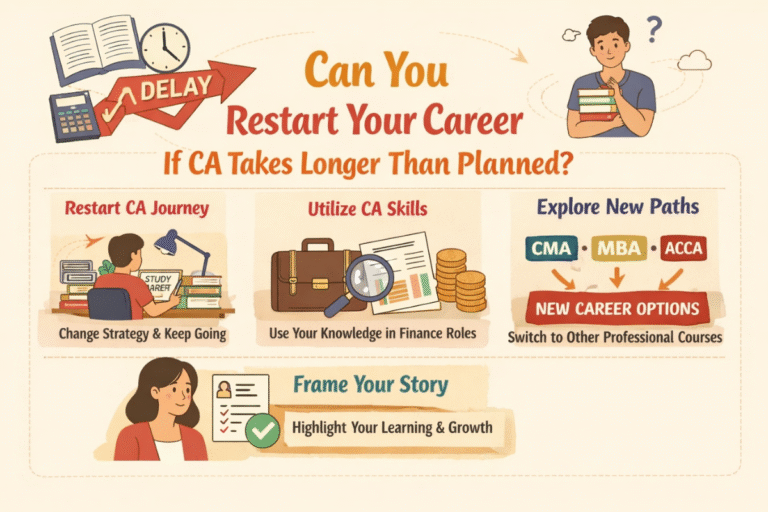

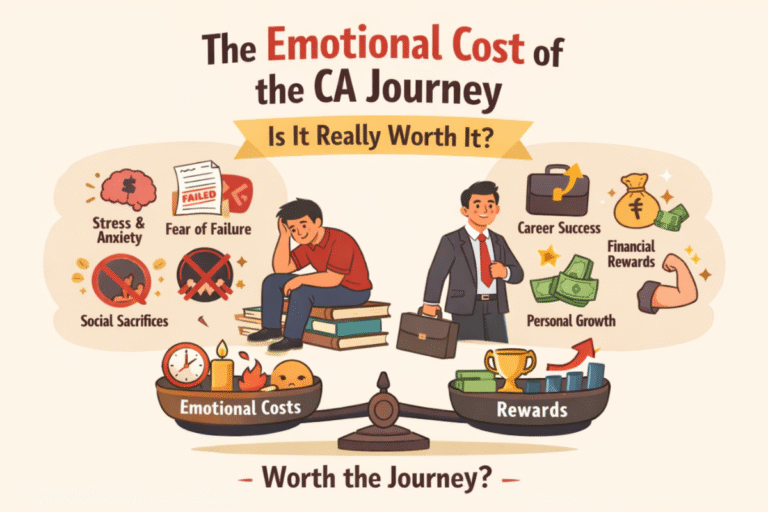

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.