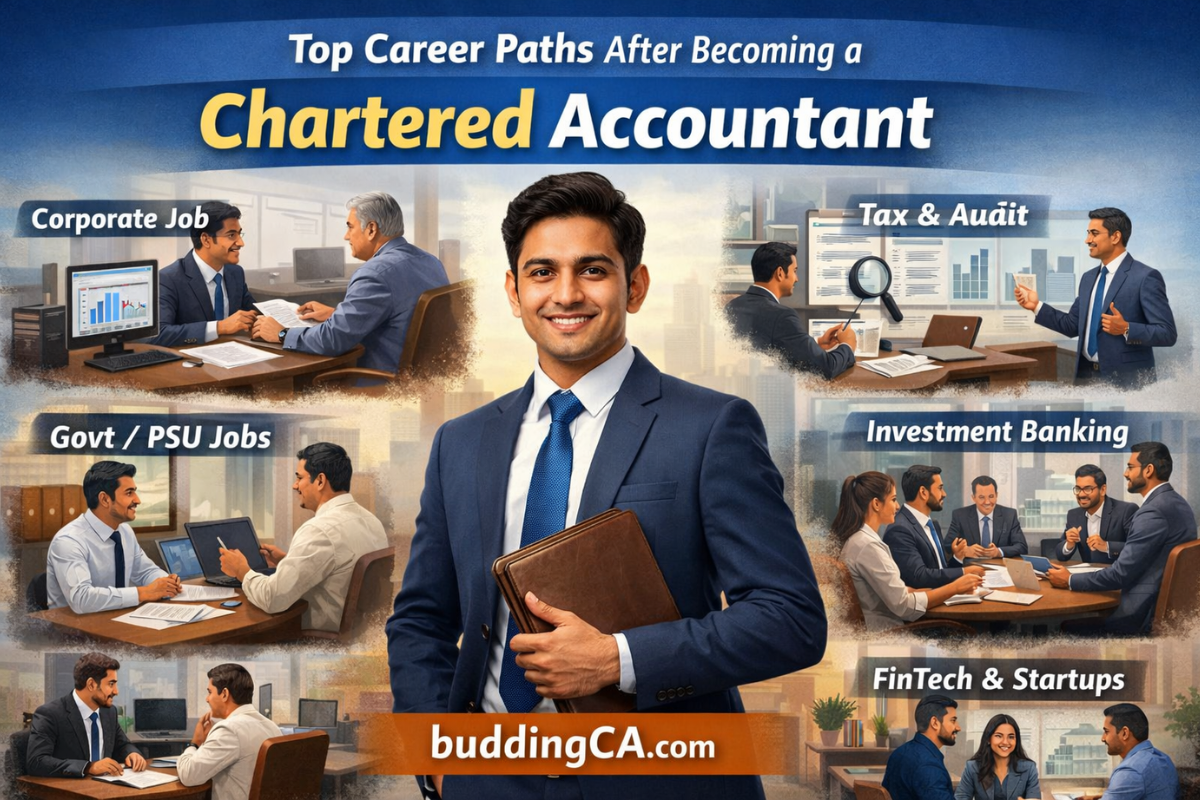

Becoming a Chartered Accountant (CA) is one of the toughest professional achievements in India. You study for years, face repeated exams, complete articleship, and deal with pressure from family, society, and yourself. When you finally pass CA Final, everyone congratulates you. But after the celebrations, one big question starts troubling you:

“What should I do now?”

Many newly qualified CAs feel confused at this stage. Some people tell you to join a Big 4 firm. Some say starting your own practice is the best option. Others talk about high-paying jobs, working abroad, or moving into finance and consulting. Because of so many opinions, it becomes difficult to decide.

This article is written to help you understand all major career paths after becoming a Chartered Accountant, in very simple English, so that even if your English is not strong, you can still clearly understand every option and make the right decision for your future.

Corporate Job (Industry Career)

This is the most common career path chosen by CAs after qualification.

What does a CA do in a company?

In a corporate job, you work as part of the finance or accounts team. Your responsibilities usually include:

- Maintaining books of accounts

- Preparing financial statements

- Handling GST and income tax compliance

- Budgeting and cost control

- Ensuring legal and financial compliance

In the beginning, your work may look routine. But as you gain experience, you start taking important financial decisions for the company.

Growth in corporate roles

Most CAs start with roles like:

- Accounts Executive

- Finance Manager

- Assistant Controller

With time and experience, you can grow into:

- Financial Controller

- Head of Finance

- Chief Financial Officer (CFO)

Salary expectation

- Fresh CA: ₹8–15 lakh per year

- 5–7 years experience: ₹20–35 lakh per year

- Senior roles: Much higher, depending on company size

Who should choose this path?

This path is best if:

- You want a stable monthly salary

- You prefer fixed working structure

- You want predictable growth

- You are not comfortable with business risk

Starting Your Own CA Practice

Starting your own CA practice is a traditional but powerful career path.

What work does a practising CA do?

A practising CA usually handles:

- Income tax returns and tax planning

- GST registration, returns, and notices

- Statutory audit and tax audit

- Company law compliance

- Advisory services for businesses

Over time, many CAs specialise in one area instead of handling everything.

Reality of the initial years

It is important to understand the truth:

- Income is low in the first 1–2 years

- Client building takes time

- You may feel insecure initially

Many people quit practice early because they expect fast income, which is not realistic.

Long-term benefits of practice

If you stay patient and consistent:

- Income grows steadily

- You build your own professional brand

- You enjoy independence

- There is no income limit

Who should choose practice?

Choose this path if:

- You want to be your own boss

- You enjoy dealing with clients

- You are patient and disciplined

- You think long-term

Practice is slow in the beginning but very rewarding later.

Career in Taxation (Direct and Indirect)

Taxation is one of the strongest and safest career options for CAs.

Types of taxation work

You can work in:

- Income Tax compliance and litigation

- GST compliance, audits, and notices

- International taxation

- Transfer pricing

- Tax advisory

Why is taxation a good career

- Tax laws keep changing

- Every business needs tax advice

- Litigation and scrutiny cases are increasing

- Experienced tax professionals earn very well

Where can you work?

- CA firms

- Consulting firms

- Corporate tax departments

- Independent tax practice

Who should choose taxation?

This is suitable if:

- You enjoy reading law sections

- You like interpretation and analysis

- You are ready for continuous learning

Taxation gives authority, respect, and long-term relevance.

Audit and Assurance Career

Audit is the core foundation of the CA profession.

What does an auditor actually do?

An auditor:

- Verifies financial records

- Checks compliance with laws

- Reviews internal control systems

- Identifies risks and errors

Audit helps you understand how businesses operate from inside.

Types of audit roles

- Statutory audit

- Internal audit

- Forensic audit

- Risk and compliance audit

Benefits of audit experience

- Strong understanding of different industries

- Highly respected experience

- Helps in moving to senior finance roles later

Who should choose audit?

Audit is good if:

- You are detail-oriented

- You are comfortable with deadlines

- You like structured work

Investment Banking and Corporate Finance

This is a high-paying but high-pressure career path.

Nature of work

Work usually includes:

- Financial modelling

- Company valuation

- Mergers and acquisitions

- Fund raising

- Deal structuring

Reality check

- Long working hours

- High stress

- Strong performance pressure

But at the same time:

- Learning is very fast

- Exposure is excellent

- Salary growth is high

Who should choose this?

Choose this only if:

- You can handle pressure

- You are ambitious

- You enjoy finance deeply

This career is not for everyone, and that is perfectly fine.

Management Consulting

Management consulting focuses on solving business problems.

What do consultants do?

Consultants:

- Analyse business issues

- Improve processes

- Reduce costs

- Increase profitability

Why CAs do well in consulting

CAs understand:

- Financial impact of decisions

- Business structures

- Compliance and risk areas

Who should choose consulting?

This path suits you if:

- You enjoy problem-solving

- You like presentations and analysis

- You want exposure to different industries

Government Jobs and PSU Roles

Some CAs prefer stability and security.

Where can CAs work?

- Public Sector Undertakings (PSUs)

- Government audit bodies

- Regulatory authorities

- Academic institutions

Benefits

- Job security

- Fixed working hours

- Social respect

Limitations

- Slower career growth

- Salary growth is limited compared to private sector

This path suits those who value peace of mind over fast growth.

Teaching, Training, and Knowledge-Based Careers

Many CAs discover that they enjoy teaching and mentoring.

Career options

- Teaching CA students

- Online coaching

- Creating recorded courses

- Writing finance or tax content

- Educational YouTube channels

Income reality

In the beginning, income may be low. But with consistency:

- You build a strong personal brand

- Income becomes stable and scalable

- Work flexibility increases

This path suits those who enjoy explaining concepts simply.

FinTech and Startup Careers

Startups and FinTech companies need skilled CAs.

Roles available

- Finance manager

- Compliance head

- Strategic finance partner

- CFO at later stage

Why startups hire CAs

- Financial discipline

- Compliance management

- Investor reporting

- Cost control

This path is ideal if you enjoy fast learning and dynamic work culture.

Working Abroad After Becoming a CA

Indian CAs are respected worldwide.

Opportunities available

- Corporate roles in multinational companies

- Audit and tax roles abroad

- Further certifications for local laws

Benefits

- Global exposure

- Higher earning potential

- International work experience

This option requires planning and adaptability.

How Should You Choose the Right Career Path?

Ask yourself honestly:

- Do you want stability or risk?

- Do you prefer office work or client interaction?

- Do you want fast money or long-term growth?

- What kind of lifestyle do you want?

There is no single best career path. The best career is the one that matches your personality, interest, and long-term goals.

Final Thoughts

Becoming a Chartered Accountant gives you respect, flexibility, and multiple opportunities. Your success does not depend on choosing the most popular option, but on choosing the right option for you and staying consistent.

Take your time. Think clearly. Understand yourself. A CA degree is a strong foundation. What you build on it will decide your future.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.