If you are a commerce student or a young professional, this question has probably come to your mind more than once:

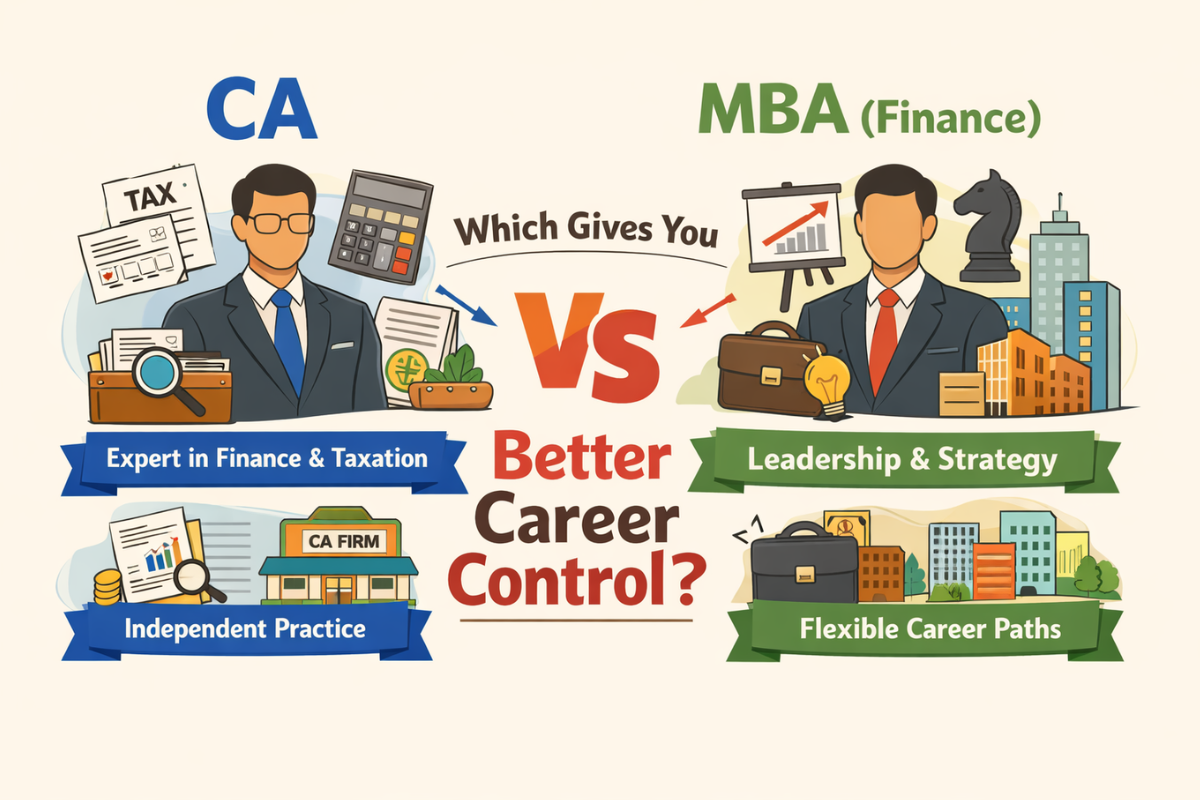

Should you become a Chartered Accountant or do an MBA in Finance?

Both are respected career options. Both can lead to good money and status. But when you look beyond salary and placements, a deeper question matters more in the long run — which option gives you better career control?

Career control means how much power you have over your career choices. It includes your ability to choose roles, switch industries, grow independently, handle uncertainty, and decide your long-term direction without feeling stuck.

Let us break this down step by step, in very simple language, so you can make a decision with clarity.

What Do We Mean by “Career Control”?

Before comparing CA and MBA, you must understand what career control actually means.

Career control is not just about getting a job. It is about:

- How much freedom you have to choose your work

- Whether you can switch roles or industries if you want

- How dependent you are on companies or employers

- Whether you can grow independently in the long run

- How stable your career is during economic ups and downs

With this lens, let us now compare CA vs MBA (Finance) honestly.

Understanding the CA Career Path

When you choose CA, you are choosing a highly specialised professional career. You become an expert in accounting, taxation, audit, finance, and compliance.

As a CA, your core strength is technical knowledge. This knowledge is always in demand, regardless of industry.

How CA Gives You Career Control

As a CA, you get control in the following ways:

- Professional independence: You are not limited to corporate jobs. You can start your own CA practice, consultancy, or firm. This gives you full control over your clients, working hours, and income growth.

- Evergreen demand: Every business needs compliance, tax filing, audits, and financial reporting. Even during slow economic periods, CAs remain relevant.

- Authority and credibility: A CA degree gives you legal and professional authority. Your signature has value. This kind of control is rare in many professions.

- Multiple career tracks: You can work in audit firms, Big 4, corporates, banks, startups, government roles, or practice independently.

Limitations You Should Be Aware Of

At the same time, you should know the reality:

- The CA course is long and mentally demanding

- Career paths are often more structured and linear

- Moving into pure strategy or general management roles can take extra effort

- Early years may involve long hours and pressure

Still, once you qualify and gain experience, your dependence on any one employer reduces significantly. That is a big form of career control.

Understanding the MBA (Finance) Career Path

An MBA in Finance is a management degree, not a professional license like CA. It teaches you finance along with strategy, leadership, operations, and decision-making.

Your career after MBA depends heavily on:

- The quality of your B-school

- Placements and internships

- Networking and soft skills

- Your ability to perform in corporate environments

How MBA (Finance) Gives You Career Control

MBA gives you control in a different way:

- Career flexibility: You are not locked into one domain. You can move between finance roles, consulting, analytics, strategy, operations, and even general management.

- Faster leadership exposure: MBA graduates often move into managerial roles earlier, especially in corporates.

- Industry mobility: You can switch industries more easily — from banking to tech, consulting to FMCG, or startups to corporates.

- Strong networks: Your batchmates, alumni, and recruiters become part of your long-term professional network.

Limitations You Must Consider

MBA also comes with its own risks:

- High fees, especially for top colleges

- Career outcomes depend a lot on the institute brand

- You remain mostly dependent on organisations for growth

- Independent practice options are limited compared to CA

If placements or roles do not align with your interest, you may feel less control early in your career.

CA vs MBA (Finance): Career Control Compared Clearly

Let us compare both options on important factors that matter to you.

Control Over Work and Income

- CA: You can build your own practice, choose clients, and scale independently. Your income is not capped by a salary structure.

- MBA: Income mostly grows through promotions, job switches, and performance reviews.

If independence matters to you, CA gives stronger long-term control.

Flexibility to Change Roles

- MBA (Finance) allows easier switching between roles like finance, consulting, business strategy, and management.

- CA roles are more specialised, though you can move across audit, tax, finance, and CFO tracks.

If flexibility excites you, MBA offers more room early on.

Job Stability and Security

- CA offers higher stability because compliance and taxation are always required.

- MBA roles can be more sensitive to market conditions, especially in consulting or investment roles.

If security is important to you, CA is the safer option.

Leadership and Decision-Making Roles

- MBA prepares you directly for leadership and management positions.

- CA professionals reach leadership mainly through experience and domain expertise.

If you want structured leadership training, MBA helps. If you want authority through expertise, CA works better.

Long-Term Career Control

- A senior CA with experience and clients enjoys very high career control.

- An MBA professional’s control depends on industry demand and organisational growth.

Over 15–20 years, CA generally offers more independent control.

Which One Should You Choose?

Now comes the most important part — your mindset matters more than the degree.

Choose CA if:

- You enjoy numbers, law, tax, and problem-solving

- You value professional independence

- You are ready for a tough but rewarding journey

- You want a stable, respected long-term career

Choose MBA (Finance) if:

- You enjoy strategy, decision-making, and leadership

- You want flexibility across roles and industries

- You are comfortable with corporate structures

- You want quicker exposure to managerial roles

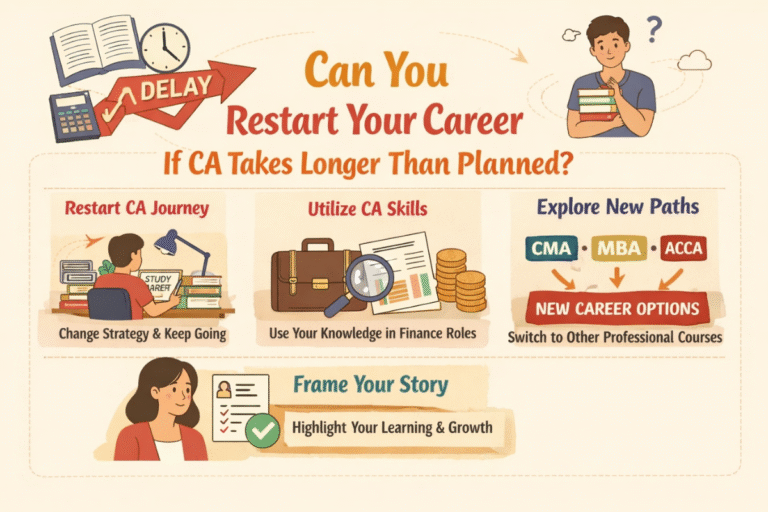

What Many Smart Professionals Do

Many successful professionals combine CA + MBA at different stages.

Some complete CA first and then do an MBA to add management skills. This combination gives maximum career control — technical authority plus strategic leadership.

However, this path requires patience, clarity, and commitment.

A Mentor’s Honest Advice to You

Do not choose CA or MBA just because of salary packages or social pressure.

Ask yourself:

- Do I want independence or flexibility?

- Do I enjoy deep technical work or broad business thinking?

- Am I comfortable with long-term effort for long-term control?

There is no universally “better” option. But there is always a better option for you.

If you choose with clarity today, you will not feel stuck tomorrow.

Final Takeaway

- CA gives you control through expertise, authority, and independence

- MBA (Finance) gives you control through flexibility, leadership, and networks

Both are powerful. The right choice depends on who you are and who you want to become.

Take time. Reflect honestly. And remember — your degree should support your life, not define it.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.