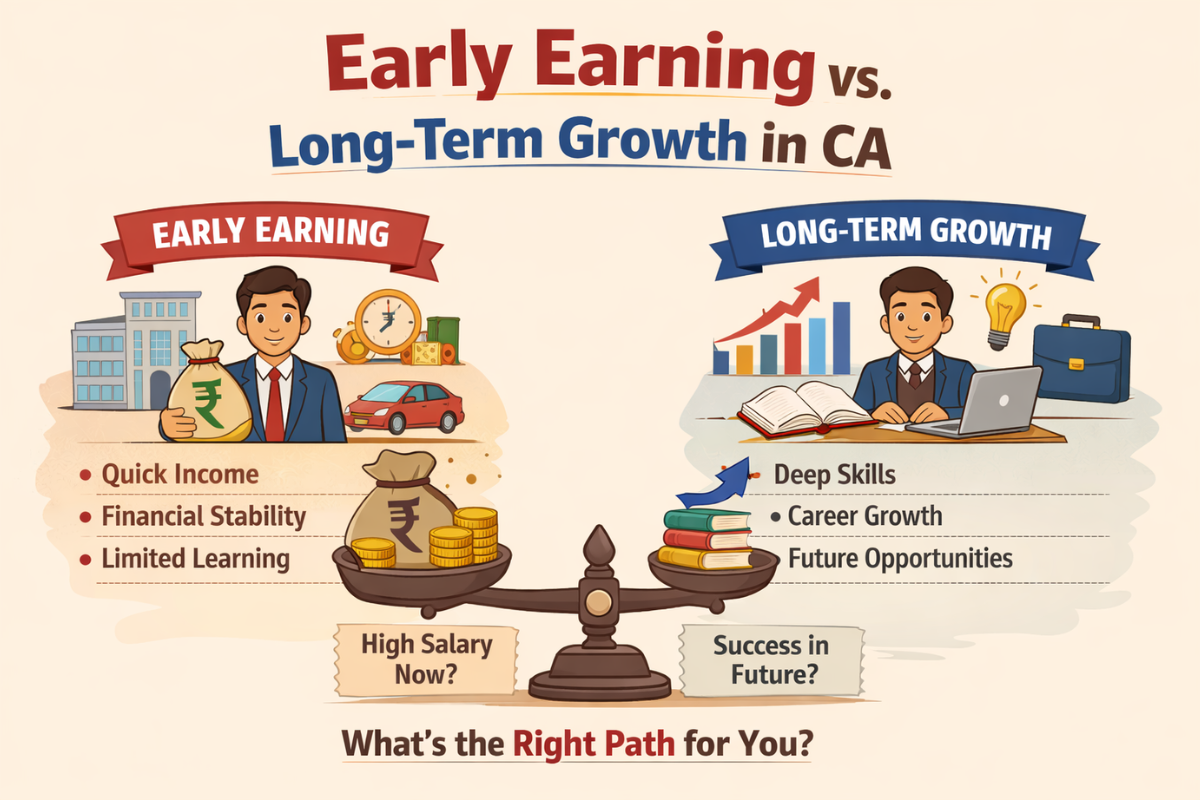

One of the biggest career questions you will face as a CA student or a newly qualified Chartered Accountant is this:

Should you start earning early, or should you focus on long-term growth even if money is slow at the beginning?

There is no one-line answer. Many students feel confused because they see different examples around them. Some seniors start earning well just after qualification. Some struggle initially but later reach very senior roles. This article will help you understand both paths clearly, so that you can take a decision that suits your life, not someone else’s success story.

Why This Decision Feels So Confusing for CA Students

As a CA student, you put in years of effort—clearing tough exams, managing articleship pressure, and sacrificing personal time. Naturally, once you qualify, you want financial stability. At the same time, you hear seniors say, “Don’t run behind money in the beginning. Focus on learning.”

Both sides sound correct. That is why this decision needs clarity, not pressure.

Before choosing any path, you must understand what early earning and long-term growth actually mean in the CA profession.

What Does “Early Earning” Mean in a CA Career?

Early earning means choosing career options that give you better income in the initial years, even if learning exposure is limited.

This can include:

- Industry roles with fixed salary immediately after articleship

- Smaller firms offering higher stipends or salaries

- Roles focused on routine compliance work with faster billing

Advantages of Early Earning

- You become financially independent sooner, which is important if you have family responsibilities or education loans.

- You get mental relief because money pressure reduces.

- You can afford courses, certifications, or a better lifestyle early.

Limitations You Must Be Aware Of

- Some early earning roles offer limited exposure to complex work.

- Skill growth may slow down if the work becomes repetitive.

- Switching to high-growth roles later can become difficult without strong experience.

Early earning is not wrong. It becomes risky only when money is chosen at the cost of learning.

What Does “Long-Term Growth” Mean for a CA?

Long-term growth means choosing roles that may pay less initially but give you strong learning, exposure, and credibility.

This often includes:

- Articleship or jobs with Big 4s or reputed firms

- Roles involving audits, advisory, taxation planning, or consulting

- Positions where you work long hours but learn different industries

Advantages of Long-Term Growth

- You build strong technical and practical skills.

- You develop confidence to handle complex cases independently.

- Your value in the market increases over time, leading to better roles and higher pay later.

Challenges in the Beginning

- Initial salary may feel low compared to peers.

- Work pressure can be high with slow financial rewards.

- You need patience and discipline to continue learning.

Long-term growth is powerful, but only if you stay consistent and intentional.

The Biggest Mistake CA Students Make

The most common mistake is copying someone else’s path blindly.

A senior earning well at 24 may not show you the struggles behind it. Another senior doing average today may be preparing for something bigger. Social media only shows outcomes, not journeys.

Your decision must be based on:

- Your financial background

- Your learning capacity

- Your long-term vision

- Your mental strength

There is no “best” path. There is only the right path for you.

Questions You Must Ask Yourself Before Deciding

Before choosing between early earning and long-term growth, honestly answer these questions.

What Is Your Financial Reality?

If your family depends on you or you have loans to repay, early earning may be practical. There is nothing wrong in prioritising stability.

If you do not have urgent financial pressure, you have the freedom to invest time in learning.

Are You Still Building Your Basics?

If you feel unsure about accounting standards, taxation concepts, or audit procedures, long-term growth roles can strengthen your foundation.

Money can wait. Weak fundamentals will hurt you for years.

Do You Want to Specialise Later?

If you want to move into areas like:

- International taxation

- Corporate advisory

- Valuations

- Forensic audit

- Start your own practice

Then early learning matters more than early salary.

How Do You Handle Pressure?

High-growth roles demand long hours and steep learning curves. If you are ready for it, growth will reward you. If not, a stable earning role may suit you better for now.

Articleship and First Job: Where This Decision Starts

Your articleship is the first place where this choice becomes visible.

Some students choose firms with:

- High exposure but low stipend

- Long hours but strong learning

Others prefer:

- Shorter hours

- Better stipend

- Limited exposure

Both choices are valid, as long as you understand the trade-off.

Similarly, your first job after qualification sets the direction. The first job does not define your entire career, but it does influence your early trajectory.

Can You Balance Both Early Earning and Long-Term Growth?

Yes, and this is often the smartest approach.

You do not need to choose one extreme.

You can:

- Take a reasonably paying job with good learning

- Use early earnings to invest in courses and skills

- Switch roles after 2–3 years once your profile improves

Growth is not only about the firm you join. It is also about what you learn actively.

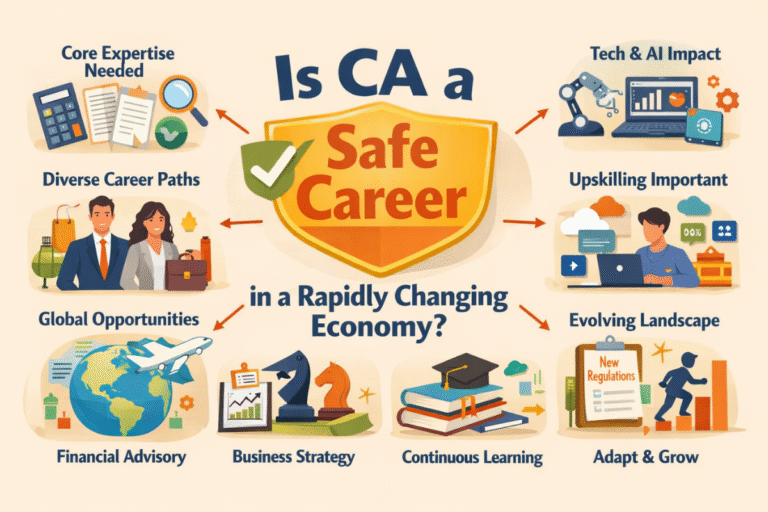

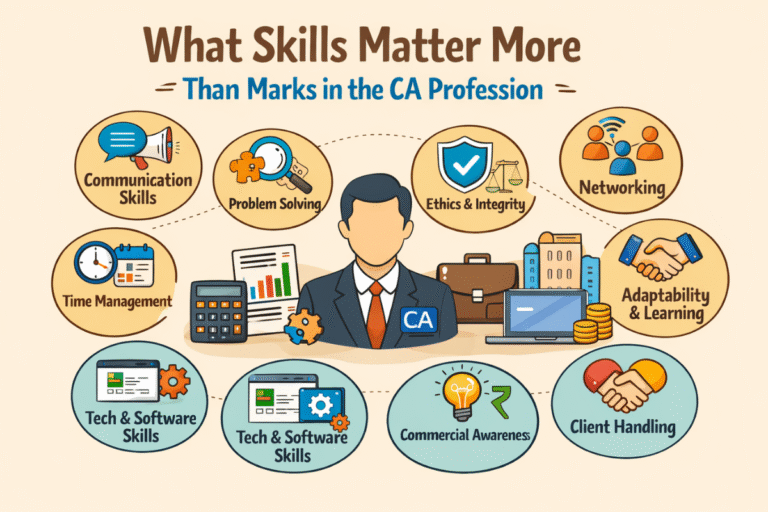

Skills That Matter More Than Salary in the Long Run

If you focus on long-term growth, ensure you are building these skills:

- Strong conceptual clarity in accounting, tax, and audit

- Ability to read and understand laws and notifications

- Communication skills to explain complex issues simply

- Professional discipline and work ethics

- Problem-solving mindset, not just compliance work

These skills multiply your earning potential later.

A Simple Framework to Help You Decide

Think of your CA career in phases:

Phase 1: Learning Phase (0–3 years)

- Priority: Exposure, fundamentals, confidence

- Income: Secondary

- Focus: Skill building

Phase 2: Growth Phase (3–7 years)

- Priority: Specialisation and role clarity

- Income: Increases steadily

- Focus: Market value

Phase 3: Leadership Phase (7+ years)

- Priority: Senior roles, practice, or consulting

- Income: Strong and stable

- Focus: Impact and authority

If you try to skip Phase 1, Phase 3 becomes difficult.

Mentor’s Advice for Budding CAs

If you are still a student or a newly qualified CA, remember this:

- Money earned early without skills fades fast.

- Skills built early compound for decades.

- You can recover from low salary years.

- You cannot easily recover from weak fundamentals.

Do not rush because others are earning. Build a career that you can be proud of at 35, not just happy about at 23.

Final Thoughts

Deciding between early earning and long-term growth is not about choosing right or wrong. It is about choosing consciously.

Understand your situation. Be honest with yourself. Take advice, but do not let comparison decide your future.

A CA degree gives you options. Use those options wisely.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.