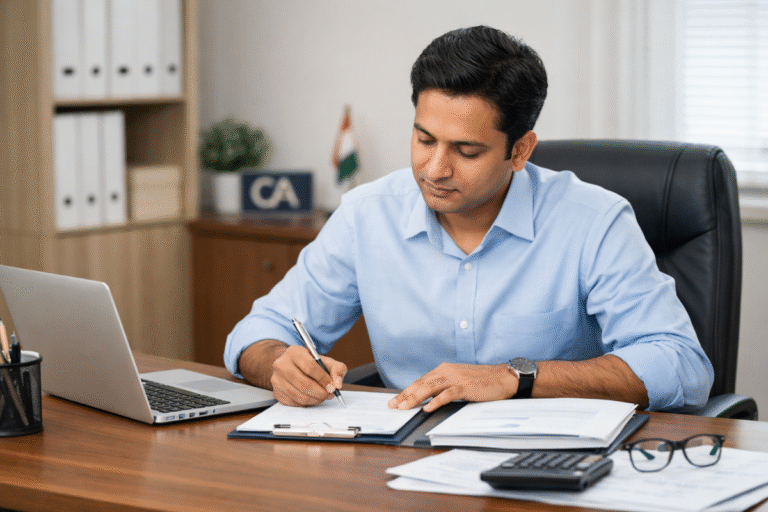

Many Chartered Accountants start their career in CA practice. They work hard, clear exams, open a firm or join a practising CA, and handle tax, audit, and compliance work. In the beginning, everything feels fine. But after some time, many CAs start thinking about a change.

You may feel that the work is becoming repetitive. You may feel tired during filing seasons. You may feel that income growth is slow or uncertain. Or you may feel that you want to work closer to business decisions, not only compliance.

This is when the idea of moving into corporate finance comes.

If you are a CA who is confused about how to move from CA practice to corporate finance, this article is written for you.

What Does Moving From CA Practice to Corporate Finance Really Mean?

Transition does not mean leaving your CA degree behind. It means changing the type of work you do.

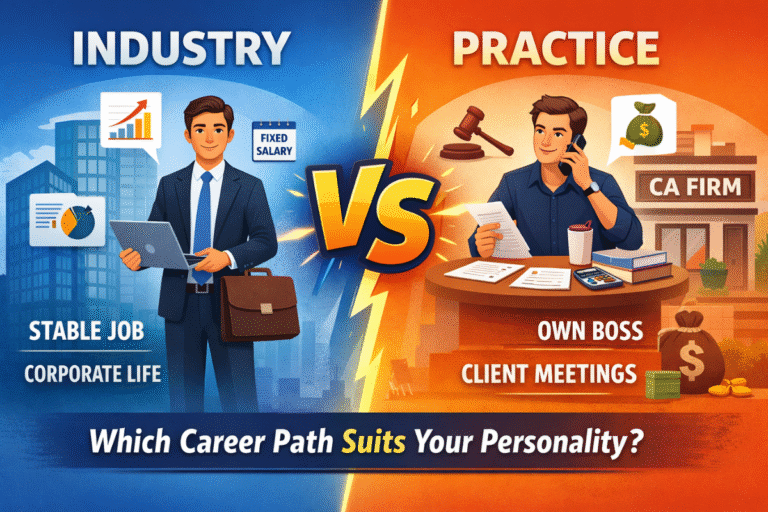

In CA Practice, Your Work Is Mostly:

- Filing income tax returns

- Filing GST returns

- Doing statutory audits

- Doing compliance-related work

- Handling many small or medium clients

- Working under heavy deadline pressure

This work is mostly rule-based. You follow laws, notifications, and due dates.

In Corporate Finance, Your Work Is Mostly:

- Analysing financial statements

- Preparing budgets and forecasts

- Helping management understand numbers

- Supporting business decisions

- Working on valuation or fund raising

- Planning company finances

This work is business-based. You help companies decide what to do with their money.

The main change is:

From following rules → to helping take decisions

Why Do Many CAs Want to Leave Practice?

It is important to understand your own reason clearly.

Common Reasons CAs Feel Stuck in Practice

- Income is not stable in early years

- Heavy pressure during tax and GST seasons

- Too much dependence on clients

- Limited learning after a point

- Difficulty in scaling practice

CA practice is not bad. Many people do very well in it. But it does not suit everyone. Some people prefer a structured job, fixed income, and long-term growth path.

Corporate finance offers:

- Fixed salary

- Structured roles

- Clear career ladder

- Exposure to business strategy

What Is Corporate Finance

Corporate finance means managing a company’s money in a smart way.

The corporate finance team helps answer questions like:

- Is the company making profit or loss?

- Where should the company invest money?

- How much money will be needed next year?

- Can the company raise funds?

- Is buying another company a good idea?

In short, you work with numbers that affect real business decisions.

Corporate Finance Roles That Are Suitable for CAs

You do not need to target every role. Some roles are easier for CAs from practice background.

Financial Analyst

In this role, you:

- Analyse financial statements

- Study trends in profit and expenses

- Prepare reports for management

This role suits you if you like numbers and analysis.

FP&A (Financial Planning and Analysis)

In this role, you:

- Prepare budgets

- Do forecasting

- Compare actual results with budgets

- Prepare monthly MIS reports

This is one of the best entry roles for CAs from audit or accounting background.

Corporate Finance Executive

In this role, you:

- Assist in valuation

- Support fund raising

- Help in preparing pitch decks

- Work on financial projections

This role gives good exposure and learning.

M&A or Investment Banking (Later Stage)

These roles involve:

- Mergers and acquisitions

- Due diligence

- Deal structuring

- Long working hours

These roles are better after some initial corporate experience.

Do You Really Have the Skills for Corporate Finance?

Many CAs think:

“I only know tax and audit. I cannot do corporate finance.”

This thinking is wrong.

Skills You Already Have From CA Practice

- Reading balance sheets

- Understanding profit and loss

- Basic cash flow analysis

- Understanding risks and controls

- Attention to detail

- Handling clients and pressure

These skills are valuable in corporate finance. You only need to add some new skills and present yourself correctly.

Skills You Must Learn to Move Into Corporate Finance

Skill upgradation is the most important step.

Excel Skills (Very Important)

You must learn:

- Excel formulas

- Pivot tables

- Data analysis

- Financial calculations

In corporate finance, Excel is used every day.

Financial Modelling Basics

You should understand:

- How income statement, balance sheet, and cash flow are linked

- How forecasts are made

- How assumptions affect numbers

You do not need to become an expert. Basic understanding is enough to start.

Valuation Basics

You should know:

- What is DCF

- What are comparables

- Why valuation is needed

Even basic knowledge improves your confidence a lot.

Communication and Presentation

You must learn to:

- Explain numbers in simple words

- Prepare short reports

- Make simple presentations

Corporate finance is not only about calculations. It is also about explaining numbers clearly.

How to Prepare While You Are Still in CA Practice

You do not need to resign immediately.

Smart Preparation Plan

- Spend 1 to 2 hours daily

- Learn Excel properly

- Learn financial modelling basics

- Read company annual reports

- Understand how businesses earn money

If you do this consistently, 3 to 6 months is enough for basic preparation.

How to Change Your CV for Corporate Finance

A normal CA practice CV will not work.

What to Reduce in Your CV

- Too much focus on compliance

- Listing number of returns filed

- Technical tax language

What to Highlight Instead

- Financial analysis work

- Advisory exposure

- Any budgeting or projections done

- Business understanding

Simple Example

“Handled GST compliance of multiple clients”

“Analysed financial data to support client business planning”

Your CV should look like a business finance CV, not a practice CV.

How to Get Your First Corporate Finance Job

The first job is the toughest.

Where to Apply

- Small or mid-size companies

- Startups

- Boutique advisory firms

- Finance teams of growing businesses

Do not wait only for big brands. Learning matters more than brand in the beginning.

Even a junior role is fine if:

- You get exposure

- You learn practical work

- You build experience

Using LinkedIn to Support Your Transition

LinkedIn is very useful if used correctly.

What You Should Do

- Update your headline clearly

- Share finance learnings

- Comment on finance posts

- Connect with finance professionals

Do not directly message people asking for jobs. Build visibility and trust first.

Salary Reality You Must Accept

This is a sensitive topic.

If you are earning well in CA practice, your first corporate job may pay:

- Same salary

- Or slightly lower salary

But corporate finance offers:

- Faster growth

- Better learning

- Better long-term income

Think in 3 to 5 year time frame, not just monthly income.

How Corporate Finance Interviews Are Different

Interviews are not exam-based.

Interviewers Check

- How you think

- How you explain numbers

- Your business understanding

- Your communication clarity

Common Questions

- Why do you want to leave practice?

- How does your CA background help?

- Explain a financial decision you handled

Never say you are bored or frustrated. Say you want business exposure and growth.

Common Mistakes CAs Make During Transition

Avoid these mistakes:

- Waiting for perfect opportunity

- Not upgrading skills

- Applying with wrong CV

- Expecting senior roles immediately

- Ignoring networking

Transition is gradual. Be patient and consistent.

How Long Does the Transition Take?

Usually:

- 3 to 6 months with focused effort

- 6 to 12 months with slow preparation

There is no fixed rule. Consistency matters the most.

Final Conclusion

Moving from CA practice to corporate finance is completely possible. Many CAs have already done it successfully. Your CA degree is a strong foundation. You only need to use it in a different way.

If you enjoy:

- Analysing numbers

- Understanding business

- Structured career growth

Corporate finance can be a good option for you.

Start preparing today. Take small steps. Over time, those steps can change your entire career direction.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.