Financial Planning and Analysis (FP&A) is an essential function in businesses of all sizes across India. Whether it is a startup or a large multinational corporation, FP&A professionals play a pivotal role in ensuring the company’s financial health and guiding its strategic decisions. However, the exact role and scope of work of Financial Planning Analysts may vary significantly depending on the size of the organisation, the industry sector, and the company’s specific needs.

In this article, we will explore in detail what Financial Planning Analysts do, their key responsibilities, the types of reports they prepare, and why they are crucial to any business’s success. We will also look at how their role evolves as one climbs the corporate ladder and what skills and qualities make an FP&A professional stand out.

Understanding the Role of Financial Planning Analysts

At its core, Financial Planning and Analysis involves analysing a company’s financial data to help guide business strategy and operations. FP&A professionals act as a bridge between various departments and senior management. They transform raw data into meaningful insights, enabling leaders to make informed financial decisions.

In India, the FP&A function is often part of the broader Business Finance or Corporate Finance team. This team supports all financial aspects of business operations, from budgeting and forecasting to risk management and reporting.

Why is FP&A Important?

Every business decision, whether related to launching a new product, entering a new market, or managing costs, has financial implications. FP&A ensures these decisions align with the company’s financial goals and strategies. By scrutinising numbers and trends, FP&A analysts validate assumptions and forecast outcomes, reducing financial risks.

Key Responsibilities of Financial Planning Analysts

FP&A professionals wear many hats. Their work goes far beyond simple number crunching. Some of their common responsibilities include:

1. Preparing Financial Reports and Budgets

One of the foundational tasks of FP&A is preparing detailed financial reports. These reports provide a snapshot of the company’s current financial position and past performance. Budgets are prepared to set spending limits and financial targets for departments or projects.

2. Analysing Financial and Operational Data

FP&A analysts dive deep into both financial and operational data to extract actionable insights. They identify trends, spot potential issues, and measure performance against budgets and forecasts.

3. Developing Financial Forecasts and Plans

Forecasting is critical in predicting future revenues, expenses, and cash flows. FP&A teams build financial models that help the company anticipate various business scenarios and prepare accordingly.

4. Providing Financial Advice to Management

FP&A professionals are trusted advisors to business leaders. They guide management on the financial feasibility of plans, recommend cost-saving opportunities, and assess investment proposals.

5. Approving Major Expenses

In many organisations, FP&A professionals have the authority to approve significant expenses, such as capital expenditures (capex) or purchase orders (POs), ensuring spending is justified and within budget.

6. Managing Financial and Business Risks

By stress testing financial models and analysing sensitivity, FP&A teams identify and mitigate risks that could impact the company’s financial health.

Detailed Illustration: The Capital Expenditure Approval Process

To understand the depth of FP&A’s involvement, consider the example of a senior FP&A manager chairing a capital expenditure approval committee. Capital expenditure refers to money spent on acquiring or maintaining fixed assets, such as machinery, buildings, or technology.

In this role, the FP&A manager:

- Acts as Leader by assessing whether proposed projects align with the company’s strategic goals and reviewing the financial case for each.

- Becomes the Driver by ensuring the resources and manpower are available to execute projects and deliver the expected returns.

- Plays the Operator role by overseeing the correct application of accounting policies, such as depreciation.

- Acts as the Financier by agreeing on funding plans, including obligations and rights.

- Serves as the Custodian by formally approving capex and ensuring no funds are released without proper authorisation.

This example demonstrates the multifaceted nature of the FP&A role, combining strategic oversight with hands-on operational control.

Common Reports and Reviews Handled by FP&A Professionals

FP&A teams produce a variety of reports and conduct reviews that are vital for business planning and control. Here is a closer look at some of these:

1. Planning and Budgeting Reports

- Annual Operating Plan (AOP): A comprehensive plan outlining the company’s expected financial performance for the year.

- Quarterly Plans: Detailed financial plans revisited every three months.

- Monthly or Quarterly Budgets: Budgets help control expenditure and resource allocation.

- Headcount Planning: Forecasting staffing needs aligned with business growth.

- Long-Range Strategic Planning: Financial strategies and forecasts that extend over several years.

2. Reporting and Analysis

- Operational Reporting: Monitoring day-to-day business operations.

- Financial Reporting: Tracking financial results and compliance.

- Key Performance Indicators (KPIs): Metrics that measure success against objectives.

- Dashboards: Visual tools summarising key financial and operational data.

- Variance Analysis: Comparing actual results with budgets or forecasts to identify deviations.

- Price Volume Mix (PVM) Analysis: Examining the impact of changes in price, volume, and product mix on sales.

- Drill-through/Roll-up/Drill-across Reports: Techniques to explore data at granular or summary levels.

3. Forecasting

- Rolling Forecasts: Continuously updated forecasts that reflect recent developments.

- Trend Analysis: Examining data patterns over time to predict future performance.

- Predictive Analytics: Using statistical models to anticipate outcomes.

4. Financial Modelling

- What-If Analysis: Testing various hypothetical scenarios to understand potential impacts.

- Scenario Analysis: Evaluating how different business conditions might affect the company.

Career Progression in FP&A

Starting a career in FP&A typically involves preparing many reports and financial models under the supervision of senior professionals. As you gain experience, your role shifts more towards reviewing reports, advising management, and leading projects.

At the senior levels, such as Vice President (VP) or Chief Financial Officer (CFO), FP&A professionals directly influence company strategy. Their financial analyses and forecasts are the basis for critical decisions that shape the company’s future.

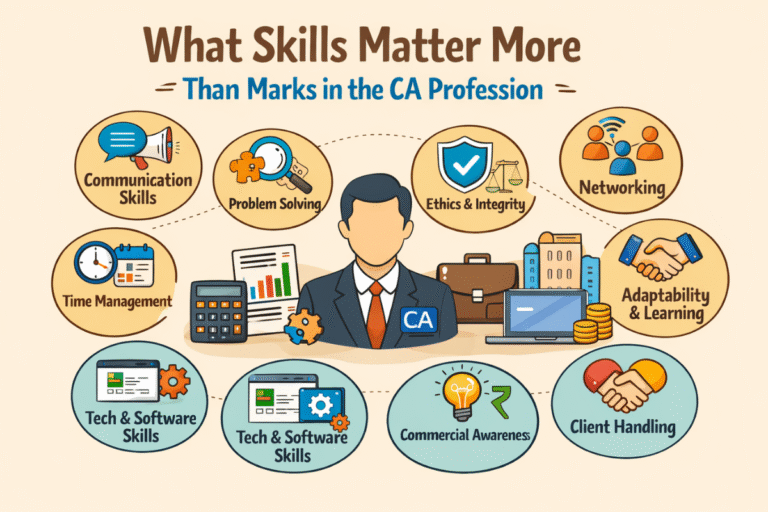

Skills and Qualities of Successful FP&A Professionals

To excel as a Financial Planning Analyst, one must possess a combination of technical and soft skills, including:

- Strong Analytical Ability: Comfort with numbers and the capacity to interpret complex data.

- Attention to Detail: Accuracy in data preparation and review is crucial.

- Business Acumen: Understanding the broader business context beyond finance.

- Communication Skills: Ability to explain financial concepts clearly to non-finance stakeholders.

- Problem-Solving: Identifying issues and proposing practical solutions.

- Proficiency in Tools: Expertise in Excel, ERP systems, and financial modelling software.

- Adaptability: Managing multiple tasks and shifting priorities in a dynamic environment.

Challenges Faced by FP&A Teams

The FP&A role, while rewarding, is not without challenges:

- Managing vast amounts of data with tight deadlines.

- Coordinating with multiple departments, each with different priorities.

- Dealing with uncertainty and rapidly changing business environments.

- Ensuring accuracy in financial forecasts despite volatile market conditions.

However, these challenges also present opportunities for FP&A professionals to demonstrate their value and impact on business success.

Conclusion

Financial Planning and Analysis is a cornerstone of effective business management in India today. FP&A professionals ensure that every financial decision is backed by rigorous analysis, supporting sustainable growth and profitability. Their role extends across budgeting, forecasting, reporting, risk management, and strategic advice, making them indispensable to any organisation.

For aspiring finance professionals, a career in FP&A offers a dynamic, challenging, and rewarding path with opportunities to influence business strategy at the highest levels.

To prepare for a career in FP&A, it is advisable to build a strong foundation in finance and accounting principles, develop advanced analytical skills, and gain hands-on experience with financial tools and models. Numerous training programmes and masterclasses are available to hone these skills and increase employability in this in-demand field.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.