If you’ve just passed your 12th exams and dream of becoming a Chartered Accountant (CA), congratulations — you’ve chosen one of the most respected and rewarding professions in India. A CA isn’t just someone who manages accounts; they are financial experts who understand business deeply, help organisations grow responsibly, and play key roles in shaping the economy.

But if you’re wondering, “What exactly should I do after 12th to become a CA?”, this detailed guide is for you. Let’s go step by step.

Understanding What a CA Does

Before you start your CA journey, it’s important to understand what this profession involves. Chartered Accountants handle areas like:

- Auditing and Assurance – Checking financial records to ensure accuracy and compliance.

- Taxation – Preparing and filing taxes, giving tax-saving advice, and representing clients before authorities.

- Financial Management – Helping companies make wise financial decisions.

- Corporate Law and Compliance – Making sure businesses follow all legal and financial rules.

- Consulting and Strategy – Advising clients on business growth, mergers, and investments.

So, as a CA, you don’t just work with numbers — you guide people and companies to make smart financial decisions.

Who Can Become a CA After 12th?

Here’s the good news — any student can become a CA after 12th, no matter what stream you chose (Commerce, Science, or Arts). However, if you studied Commerce, you already have an advantage because subjects like Accountancy, Economics, and Business Studies are part of your syllabus.

If you are from Science or Arts, don’t worry. You can still succeed as long as you’re willing to learn and put in effort to understand commerce concepts. The CA course starts from the basics, so your background won’t stop you from achieving your dream.

The Structure of the CA Course

The Institute of Chartered Accountants of India (ICAI) manages the CA course. The journey to becoming a CA after 12th includes three main levels:

- CA Foundation

- CA Intermediate

- CA Final

Along with these, you also need to complete practical training (articleship) before becoming a qualified Chartered Accountant.

Let’s look at what each stage involves.

Step 1 – Register for the CA Foundation Course

After your 12th exams, the first step is to register for the CA Foundation Course. You can do this once you’ve cleared your board exams, even before your results are officially announced.

The CA Foundation Course is the entry-level exam that tests your basic understanding of subjects related to accounting and business. It’s held twice a year – in June and December.

CA Foundation Subjects:

- Paper 1: Principles and Practice of Accounting

- Paper 2: Business Laws and Business Correspondence & Reporting

- Paper 3: Business Mathematics, Logical Reasoning and Statistics

- Paper 4: Business Economics and Business & Commercial Knowledge

To clear the exam, you must secure at least 40% in each paper and 50% in aggregate.

How to Prepare

Start by getting the official ICAI study material — it’s detailed, easy to follow, and completely free. You can also join a coaching institute or study online, but the key is consistency.

Make a timetable, revise regularly, and practice multiple-choice questions (MCQs), as two of the four papers are objective in nature.

Step 2 – Pass the CA Foundation Exam

The Foundation exam tests both your understanding and your ability to apply concepts. It’s usually conducted offline (pen-paper format).

You can appear for the exam after completing a minimum of four months of study period from the date of registration.

Once you pass the CA Foundation exam, you officially enter the professional world of Chartered Accountancy.

Step 3 – Register for the CA Intermediate Course

After clearing the Foundation level, the next stage is CA Intermediate. This level is more detailed and introduces you to the core subjects of accountancy, taxation, auditing, and financial management.

The Intermediate level has two groups, each with four papers:

Group 1:

- Accounting

- Corporate Laws

- Cost and Management Accounting

- Taxation

Group 2:

- Advanced Accounting

- Auditing and Assurance

- Financial Management and Strategic Management

- Economics for Finance

You can attempt both groups together or one at a time, depending on your preparation and confidence level. Many students prefer taking one group first to balance studies and training later.

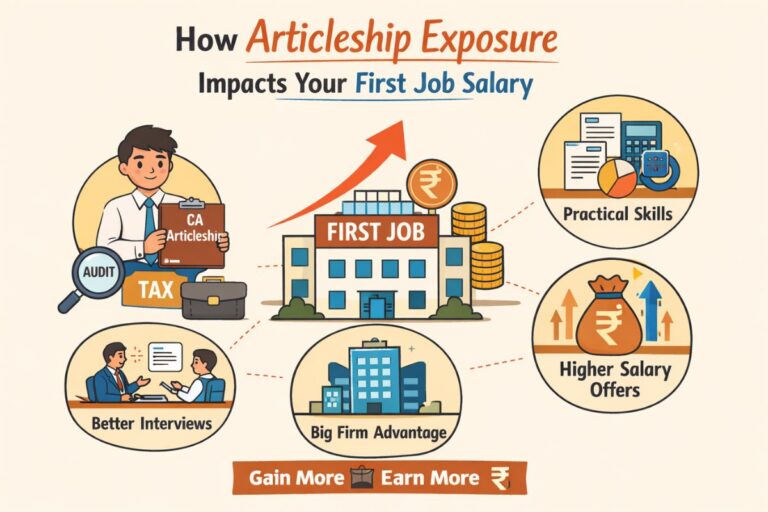

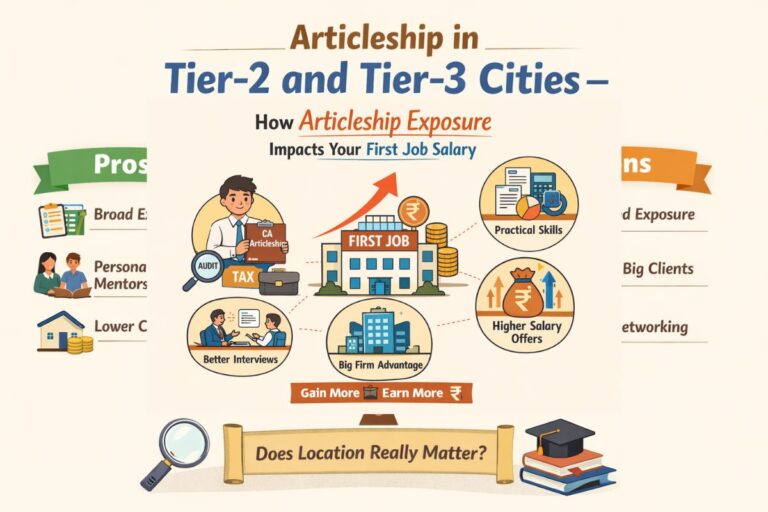

Step 4 – Articleship (Practical Training)

Once you pass either one or both groups of CA Intermediate, you can start your articleship. This is a three-year practical training period under a practising Chartered Accountant or a CA firm.

Articleship is one of the most valuable parts of your CA journey because it teaches you what real-life accounting and business work looks like. You’ll apply what you’ve studied to actual clients, audits, and companies.

During these three years, you’ll learn:

- How to conduct audits

- How to file tax returns

- How to communicate with clients

- How to manage financial records and compliances

Think of it as your “on-the-job MBA” – you’ll gain skills that no textbook can fully teach you.

Step 5 – Register for the CA Final Course

Once you complete your articleship and pass both groups of CA Intermediate, you’re eligible to register for the CA Final — the last and most challenging stage.

The CA Final syllabus includes advanced topics like Financial Reporting, Strategic Financial Management, International Taxation, and Professional Ethics.

After months (and sometimes years) of preparation and discipline, this is your last hurdle before you officially become a Chartered Accountant.

Step 6 – Become a Member of ICAI

When you clear all CA Final papers and complete your articleship, you can apply for membership in the ICAI. Once approved, you’ll be awarded your CA certificate and can proudly add the “CA” title before your name.

You can then:

- Work in a company as a finance or audit professional

- Join a CA firm as a partner or senior associate

- Start your own independent CA practice

How Long Does It Take to Become a CA After 12th?

The total time to become a CA after 12th depends on how quickly you pass each stage, but generally it takes around 4.5 to 5 years.

Here’s a simple timeline to understand the duration:

| Stage | Approx. Time |

|---|---|

| CA Foundation | 6 months |

| CA Intermediate | 1.5 years |

| Articleship | 3 years |

| CA Final | 6–12 months (during or after training) |

So, if you stay consistent and clear all levels on your first attempt, you can become a Chartered Accountant by the age of 22 or 23.

Skills You Should Develop Along the Way

While academic preparation is important, the CA journey also demands personal growth. As you move ahead, work on building these skills:

- Time Management: Balancing studies, training, and personal life.

- Analytical Thinking: Understanding numbers and interpreting data logically.

- Communication: Explaining complex ideas clearly to clients and colleagues.

- Discipline: Studying regularly without waiting for motivation.

- Problem-Solving: Making decisions in uncertain financial situations.

These skills will not only help you clear exams but will also make you a successful professional.

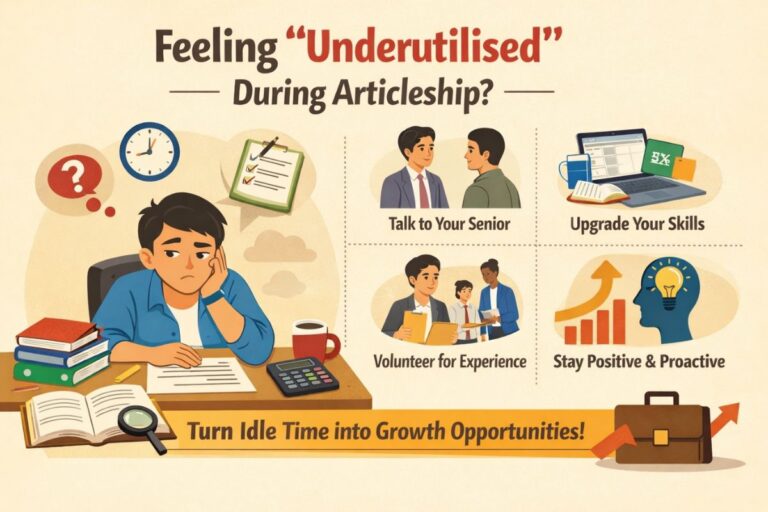

Common Challenges Students Face

Becoming a CA isn’t easy — and that’s what makes it so respected. Here are some challenges students often face:

- Lengthy Course Duration: It’s a long journey that requires patience.

- High Difficulty Level: The syllabus is deep, and exams are competitive.

- Balancing Articleship and Study: Managing both can feel overwhelming at times.

- Fear of Failure: Many students don’t clear exams on the first attempt, which can be discouraging.

But remember — failure in CA doesn’t mean you’re not capable. It simply means you need more time and better strategies. Thousands of successful CAs today failed once or twice but kept going. Persistence matters more than perfection.

Tips to Succeed as a CA Student

Here are a few tried and tested tips that can make your journey smoother:

- Start Early: Register for the Foundation course right after your 12th exams.

- Create a Study Plan: Make a timetable and stick to it.

- Revise Regularly: Revision is more important than new study material.

- Practice MCQs and Mock Tests: They help you understand your weak areas.

- Stay Updated: Read business news, finance updates, and ICAI announcements.

- Join Study Groups: Discussing topics with peers can help you remember better.

- Balance Health and Studies: Don’t skip sleep or meals during exams — your brain needs energy.

- Seek Guidance: Talk to senior students or mentors who’ve cleared CA.

Success in CA comes from daily discipline, not overnight miracles.

Career Opportunities After Becoming a CA

Once you earn your CA qualification, many doors open for you. Some popular career paths include:

- Public Practice: Start your own CA firm and offer audit, tax, or consulting services.

- Corporate Sector: Join private or public companies as a finance manager, auditor, or CFO.

- Government Jobs: Work with PSUs, the Comptroller and Auditor General (CAG), or in tax departments.

- International Opportunities: Indian CAs are recognised globally, especially in countries like UAE, Canada, and the UK.

- Entrepreneurship: Use your financial skills to start or manage your own business.

Final Thoughts

If you’re reading this soon after finishing your 12th, remember — your decision to become a Chartered Accountant is bold and ambitious. The road ahead won’t be easy, but it will definitely be worth it.

Every hour you invest today — every chapter you revise, every problem you solve, every doubt you clear — brings you one step closer to your goal.

Becoming a CA is not just about clearing exams. It’s about developing a professional mindset, learning to think logically, and growing into a person who adds value to every business you work with.

So, start today.

Register for the Foundation course, plan your study routine, and take the first confident step towards your dream career.

Because the journey of a thousand audits begins with a single registration form — and that form could be yours.

Calling all CA dreamers!

🔴 Are you tired of searching for the perfect articelship or job?

Well, fear no more! With 10K+ students and professionals already on board, you don't want to be left behind. Be a part of the biggest community around! Join the most reliable and fastest-growing community out there! ❤️

And guess what? It’s FREE 🤑

✅ Join our WhatsApp Group (Click Here) and Telegram Channel (Click Here) today for instant updates.